The Retroactive Date (Part 1)

In my last article I wrote about 5 key areas to review relating to limits in Claims Made policies.

This article will delve into a sometimes-misunderstood terms which is synonymous with Claims Made policies – the Retroactive Date. For this topic, I have decided to split the article into two parts. Part 2 will be posted over the coming fortnight.

What is a Retroactive Date?

The Retroactive Date is the date from which wrongful acts allegedly committed by the Insured are covered. In other words, the Retroactive Date needs to be at, or before, the date of the alleged wrongful act against a legal entity (being an individual and/or an incorporated company) which is insured by an insurance policy. Note that there can be multiple legal entities insured by the one policy.

The alleged wrongful act could lead to a formal claim, or it could also lead to a complaint (circumstance) which could evolve into a formal claim in the future. For your reference, in this article I am using the broad term of “wrongful act” to describe all manner of acts, errors, omissions or events which could give rise to a claim, or loss, under various Claims Made policies.

“Retroactive cover” is a related term used to describe the availability of cover for wrongful acts committed after the “Retroactive Date”. Both these terms are synonymous with Claims Made policies.

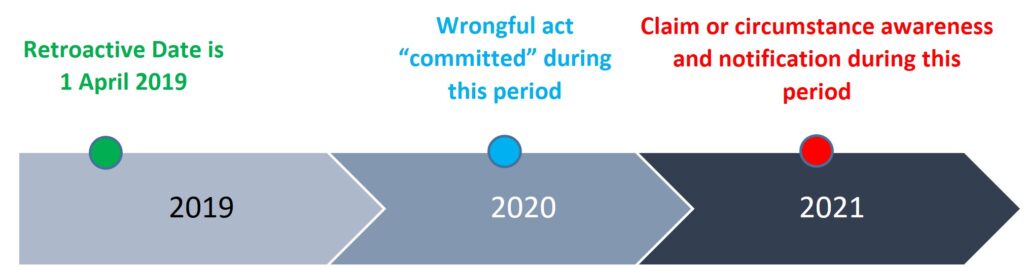

Here is an example, with a timeline, showing the Retroactive Date as being prior to the date of the alleged wrongful act:

An Actual Date or Unlimited?

The Retroactive Date can be limited to a specific calendar date, or it can also be “unlimited”.

Particularly for Professional Indemnity, the Retroactive Date tends to be set at “policy inception” for new, or first-time buyers of insurance. This is because insurers don’t like to cover wrongful acts which may have been committed prior to the first date the Insured purchased an insurance policy. The diagram above is an example of an insurance policy which was first incepted on 1 April 2019 and at that time the Retroactive Date was set at “policy inception” (also 1 April 2019). Note that this Retroactive Date needs to be maintained at each renewal thereafter.

Depending on the class of insurance, however, as well as other factors, insurers may not set the Retroactive Date as “policy inception”.

For example, with Management Liability and Cyber one will often not see any retroactive cover limitations, i.e. no Retroactive Date listed (or “silent”, see next heading), or an “unlimited, excluding known claims or circumstance” Retroactive Date – which is not an “actual” date of course.

If the Retroactive Date is “unlimited”, it means that all (potential) prior wrongful acts would be covered by that Insured’s policy. In this case, insurers will place the words “excluding known claims or circumstances” (after the word “unlimited”) to make it clear that any known claims or circumstances are not covered by the policy. This relates to the “burning building” principle which stipulates that one cannot buy fire insurance for a building which is in the process of burning! Similarly, one cannot be covered under a brand-new insurance policy for a claim that has already been made. Nor can one be covered under a brand-new insurance policy for a circumstance that could evolve into a claim in the future if one was already aware of that circumstance prior to inception of the brand-new insurance policy.

Note that there are specific exclusions in Claims Made policy wordings that also address the above. They tend to be called “Known Claims or Circumstances” exclusions, or a derivative of this term. Even though there are already these exclusions built-into policies, insurers still add the words “excluding known claims or circumstances” after the word “unlimited” (next to “Retroactive Date”) in policy schedules. Insurers do this as an additional mechanism to make it crystal clear that they will not cover any known claims or circumstances.

As a footnote to this section, some insurers also set the Retroactive Date as the date of incorporation of the company being insured. This, in principle at least, would act like an “unlimited” Retroactive Date because how could a claim be made against a company for a wrongful act committed at a time before the company even existed? Also, could there have even been a wrongful act committed before the company existed? Be cautious with the above assumptions as claims can be brought in unexpected ways.

No Retroactive Date

As briefly noted above, many policies do not mention Retroactive Dates at all. This is particularly true for Directors’ & Officers’ Liability, Employment Practices Liability and Management Liability. It can also be true for Cyber and to a much lesser extent Professional Indemnity.

If one is unable to locate a Retroactive Date in the quote, policy schedule, an endorsement, or within the policy wording itself, then one could infer that there is no Retroactive Date, and therefore no retroactive cover limitation would apply. This would then mean that claims arising from all past wrongful acts should automatically be coverable (as always subject to the normal terms and conditions of the policy). Whilst one can arrive at this conclusion after careful analysis of the documents mentioned above, it is critical that you are certain of this given the potential ramifications of an error for your Insured, and therefore by extension, on you as their broker.

If you are in any doubt, contact the underwriter and ask them for clarification and ensure such clarification is confirmed in writing!

Look out for Retroactive Date (Part 2) which will be posted over the coming fortnight.

Please note that the topic discussed in this article, and many others, are more thoroughly examined in our ANZIIF / NIBA accredited training modules delivered in-person or live on-line. In addition to our modules, we also conduct training on specific topics and mentoring services to insurance professionals. Given my 18 years of broking experience I thoroughly understand what brokers do and am passionate about imparting my knowledge and experience with you. I hold a Master in Risk Management & Insurance and am also a qualified trainer. I would love to assist you with your training needs.

Disclaimer: The information provided in this article is not, and is not intended to, constitute legal or financial product advice. It is intended to provide general information in relation to the topic being discussed which is only current as at the date of this article.

The information contained in this article is protected by copyright.